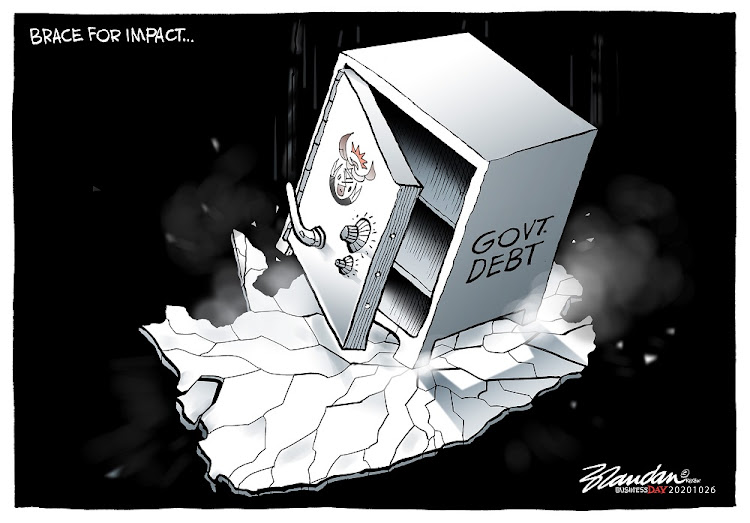

Capital market discipline will force SA to cut its lavish spending

Financing non-functional state-owned companies will be forced to stop

SA’s debt trajectory is on a troubled path; without drastic measures to curtail growing debt the market will eventually punish the state with a sudden stop in capital inflows. What I fear most is not just an inability to service the debt, nor the state being unable to finance its ever-increasing social needs. These are crucial, but when pushed against an impenetrable wall of capital market discipline the government will eventually be forced to cut its ever lavish spending needs, such as financing non-functional state-owned companies.

The risk I am worried about is an inability on the part of the SA Reserve Bank to respond appropriately to suppress inflation if it rises above the target. This might not be over the short-term, as the Bank has indicated that it is not worried about inflation over the next 18-24 months, but inflation will return at some point in the next cycle and the Bank’s monetary policy committee will not have the space to respond because it will be handcuffed by the high debt levels.

Some pundits, inflation denialists and advocates for more government spending without the necessary growth-boosting measures would like to believe inflation doesn’t matter, and that inclusive growth can happen with structurally higher inflation. They say: let’s not worry about debt and inflation, let's just spend our way out of the recession. They say this without reference to skills and productivity, a deeply flawed ideological pivot that is not found in any country that has managed to dig itself out of recession or from low-middle income to higher income status.

Economic progress is not a function of biblical miracles but of hard choices and resolve to get to a specific desired outcome. Those choices should never seek to please everyone, especially those rent-seeking sectors of society not interested in shared progress.

Because inflation has collapsed few believe this is a problem we need to be on the lookout for. But the monetary authorities do need to be vigilant. The handcuffs are already upon them, and they will tighten more the higher the debt level rises. They’re fortunate that inflation remains muted for now.

Let’s consider the following possibility, and if it doesn’t worry the markets it should surely be at the back of policymakers’ minds. Though the final result of the US election was still outstanding at the time of writing, a Joe Biden presidency appeared the most likely outcome. Incumbent President Donald Trump might institute a legal challenge as he has indicated, but there is broad belief that ultimately he will be pushed out of office.

Biden’s election manifesto included infrastructure and green energy investment of 2.5% of US GDP per year for the next decade. That is a big stimulus directly into the real economy. Unlike the quantitative easing that resulted in asset price inflation, investment in the real economy will likely result in inflation, which the US Federal Reserve would have to respond to much sooner than the market expectation that interest rates will not change until 2023.

If this scenario were to play out, it would mean global financial conditions would tighten at a time when our debt levels are increasing faster than those of our emerging market peers. The currency would depreciate, and we may have a sudden stop in capital flows, which the Reserve Bank would need to respond to. Unfortunately, raising rates in that environment will mean our debt service costs would continue to rise and the debt level would spiral higher.

What is required is what the National Treasury has proposed — deep expenditure cuts — but this needs to be augmented by robust growth-boosting measures, because growth is the most effective way to reduce fiscal risks and fiscal dominance over monetary policy. There is a lot at stake and fiscal policy must help monetary policy create space so it can help in times of crisis. That time is fast approaching.