Coronavirus: Who will suffer most from a Chinese slowdown?

For the past week and half I have been on a roadshow seeing both institutional and retail clients across SA’s major cities and as expected they wanted know what is the impact of the outbreak of the coronavirus in China on the Chinese, South African and global economies and markets.

To be upfront and in the interest of transparency and integrity of the economic profession, I submit that this is a difficult question to answer for any self-respecting economist such as myself, who knows the limitations of their training. Economists are knowledgeable professionals and well trained in the analysis of how the economy works and how one aspect of the economy impacts other aspects. But they are poorly trained to analyse the spread of diseases and their impact on population dynamics. Therefore, at this point in time there is no way of estimating the impact of the coronavirus on economic growth or on markets with any degree of certainty.

The various estimates mushrooming from many economists and market pundits are best guesstimate based on historical events. In 2002 there was an outbreak of a Severe Acute Respiratory Syndrome (SARS) which had a negative impact on China’s economic growth. Back then, China was a relatively closed economy and a producer of low cost products – sandals, sneakers, T-shirts and cups – for the world. The SARS outbreak is said to have had a 1.0% knock on China’s economic growth.

Nearly 20 years later, the coronavirus outbreak happens when China is a changed economy deeply integrated into high value global manufacturing and services value chains. The closer of manufacturing firms and almost a complete lock down of people’s movements will likely have a bigger impact on the Chinese economy and the spillover effects on the global economy will be larger this time around compared to 2002 SARS outbreak.

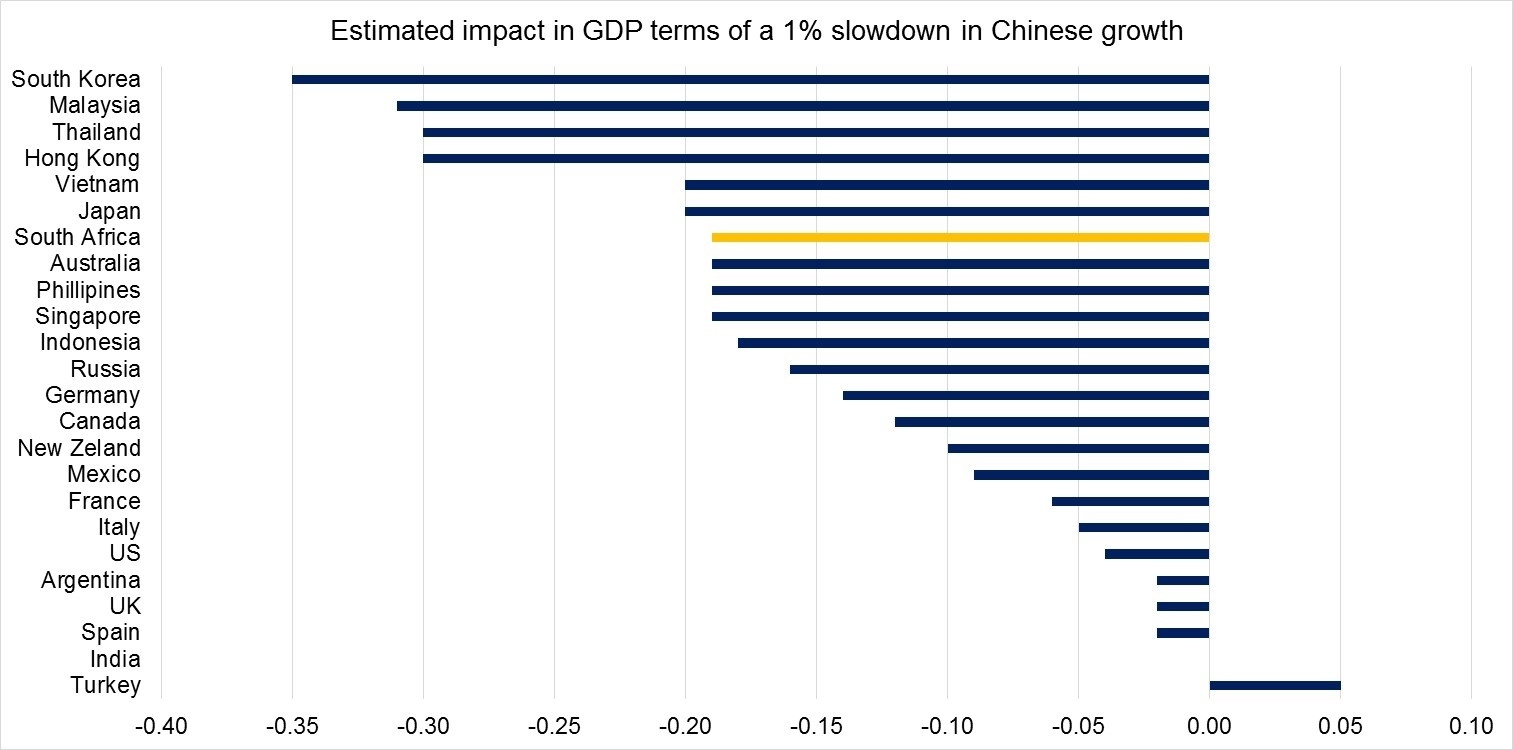

Fortunately, the folks at the IMF have done some analysis of the impact, in GDP terms, of a 1.0% decline in Chinese growth, on the major economies. Asian countries a impacted the most due to their closer integration with China while European countries and the US are impacted the least. Oddly Turkey benefits. South Africa’s growth is knocked by 0.2% and is the first non-Asian country with the highest impact.

It is quite possible the coronavirus will have an impact of more than 1.0% on China’s growth given the changed structure of the Chinese economy. By extension, the impact on these major economies will also likely be bigger than the IMF estimates. That said, the relationships are unlikely to be linear such that a 2% negative impact on Chinese growth will have more than 0.4% impact on South Africa’s economic growth.

In true fashion, the Chinese authorities have already responded by introducing liquidity into the market to cushion the economy from the impact of the coronavirus. This past Monday, the People’s Bank of China announced that it will inject US$174 billion into the market following an over 8% fall in stock market prices. Global markets followed the Chinese markets lower, but has since recovered some of the loses by midweek, which is evidence that markets always overreact to new news especially of phenomena whose impact is difficult to assess.