When assessing the future, the trend is your friend

First Published by Business Day on March 17th, 2024

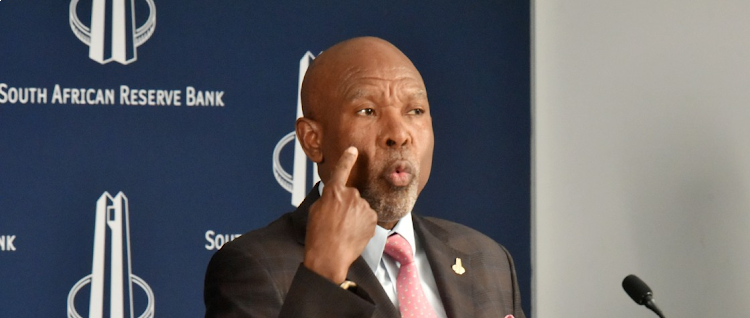

Poll or no poll, the Reserve Bank does its own thing

First Published by Business Day on February 4th, 2024

Reserve Bank had good reasons to keep the repo rate steady

First Published by Business Day on November 26th, 2023

Israel-Hamas war could escalate, leading to oil crisis

First Published by Business Day on November 12th, 2023

Markets Daily: Where has the 3% rate cuts and capital adequacy accommodation gone?

Published on September 16th, 2020

Markets Daily: Assessing SA’s capital flows performance since Covid-19 pandemic

Published on September 15th, 2020

Markets Daily: SARB likely to cut rates by 25bp driven by low growth and muted inflation expectations

Published on September 14th, 2020

Markets Daily: The hard lockdown not the sole reason for the deep contraction in SA GDP

Published on September 10th, 2020