When assessing the future, the trend is your friend

First Published by Business Day on March 17th, 2024

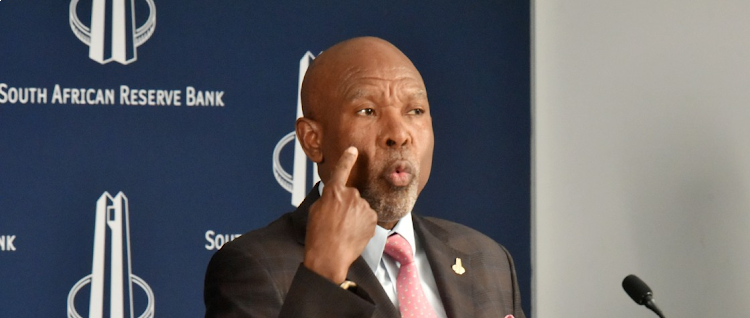

Poll or no poll, the Reserve Bank does its own thing

First Published by Business Day on February 4th, 2024

Reserve Bank had good reasons to keep the repo rate steady

First Published by Business Day on November 26th, 2023